Indian Community Advancement Block Offer (ICDBG) – getting Indian people, bands, organizations, otherwise regions, together with Alaska Indians, Aleut, and you can Eskimos that have depending relationship towards the authorities.

National Property Faith Money

The fresh National Houses Believe Money is a national houses funding directed to assist make, preserve, rehabilitate, and jobs construction affordable to the people towards the lowest profits. The brand new Tx Section off Construction acquired $step three million throughout the Federal Homes Trust Loans (HTF) given by the U.S. Agency away from Houses and Metropolitan Advancement. The first priority having Colorado’s HTF system are people-based casing that provide hyperlinks so you’re able to supportive functions for people with disabilities or unique demands. Another concern is improvements that creates devices within 30% AMI rents that would never be possible instead HTF money. Tx Division of Houses (DOH) allocates it financial support for the Colorado and you will studies apps toward a rolling basis through their Grants and Loans program processes.

Low income Property Taxation Loans

The lower-Earnings Houses Taxation Credit (LIHTC) subsidizes the purchase, structure, and treatment from sensible local rental homes to have low- and you can reasonable-income renters. Tax Credits was allocated on the county out-of Colorado by Colorado Homes Fund Authority

Colorado Casing Tax Credit

Colorado’s county credit are modeled following federal Construction Tax Borrowing system. Colorado’s program try to start with created in 2001 and soon after revived in the 2014, 2016, and you may 2018. During the 2019, the program is offered, permitting CHFA in order to allocate $10 million within the condition borrowing from the bank annually from inside the 20202024. CHFA is the allocating agencies toward state Affordable Houses Income tax Borrowing from the bank (state AHTC) program for the Colorado.

USDA Rural Development

- Point 533 Construction Preservation Grants (homeownership & rental)?

- Section 515 Outlying Leasing Construction Loans (rental)?

- Area 538 Be sure Program (rental)

- Section (farmworker construction)

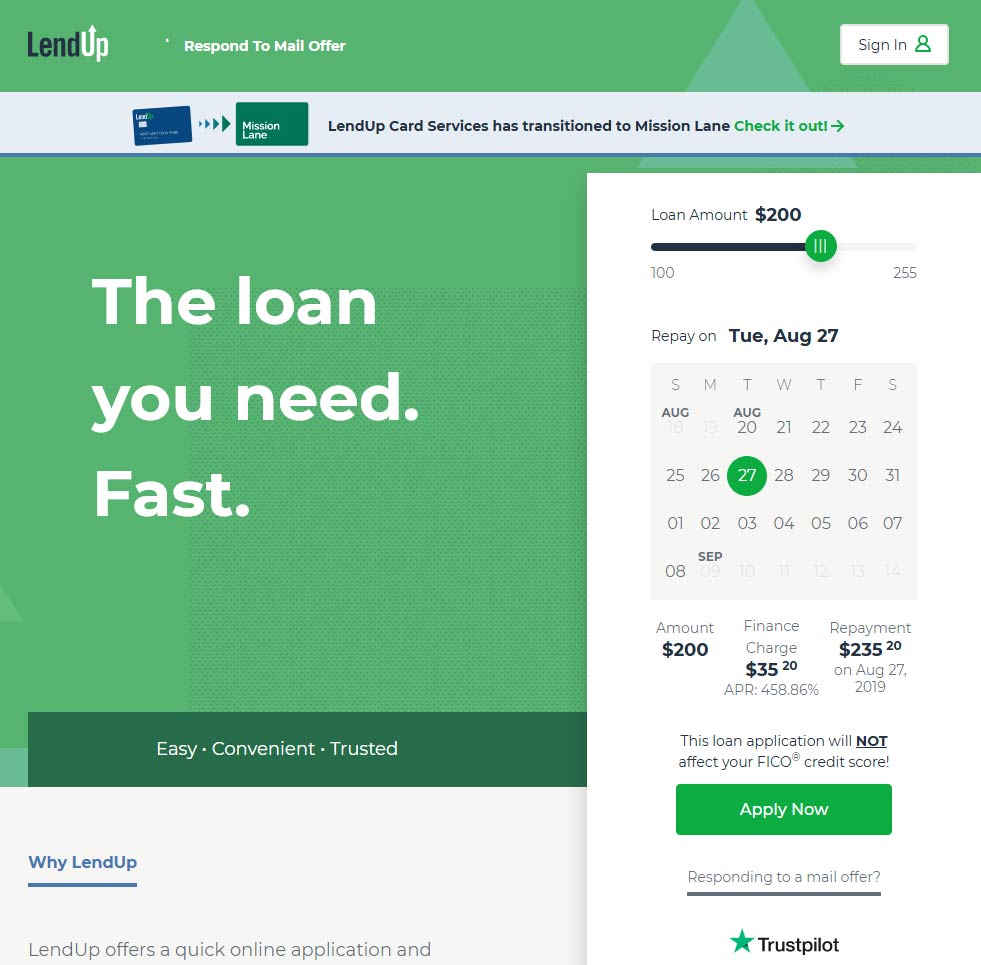

https://paydayloansconnecticut.com/baltic/

- Point 502 Casing Head Fund (homeownership) ?

- Point ?

- Shared Care about-Help Tech Advice Homes Program (homeownership) ?

- Point 502 Guaranteed Financing System (homeownership) ?

- Area 504 House Repair Grant/Financing System (homeownership) ?

Financing Magnetic Funds

The main city Magnet Funds is administered of the Treasury Department’s Community Development Creditors (CDFI) Loans while offering has to CDFIs and you can qualified nonprofit casing communities courtesy a rival. The funds can be used to funds affordable property facts, and associated economic creativity items and you may neighborhood service organization. ? Within the Tx, CHFA allocates Financial support Magnetic Funds in order to projects financed from LIHTC program. Company Community People, Effect Innovation Money and other CDFIs fool around with CMF funds to attenuate the attention pricing and you will conditions towards finance given compliment of their CDFIs.

Into the , the state of Colorado given yet another income tax borrowing from the bank toward treatment out of accredited historical houses. This borrowing expands and you will improves up on the original Federal rehabilitation tax borrowing from the bank, and you can to one another also have 20 35% borrowing to possess rehab off historical attributes.

The latest Areas Tax Loans

The brand new NMTC Program are a program of your own Agency of Treasury’s Society Creativity Lender (CDFI) loans. It attracts personal resource on the lowest-income organizations by allowing private and business people for an excellent taxation credit facing their federal income tax in exchange for making collateral opportunities inside official monetary intermediaries titled Area Innovation Entities (CDEs). The financing totals 39% of one’s modern resource number which will be said over a period of 7 ages. So you’re able to safe NMTC security, a neighborhood government or designer is to contact a great CDE which have a great NMTC allowance.

Federal Financial Lender

Offer investment readily available for reasonable construction development and you may rehab did by the Public Housing Government, Housing Designers, Area & State government Organizations, Local community Companies, Nonprofit Communities, For-Funds Communities, Habitat to own Mankind, Self-Assist Apps and you may CHDOs.

The new Homeownership Set-out System (HSP) will bring advance payment, closing prices and you will resolve help earliest-big date homeowners earning within otherwise less than 80% of one’s Urban area Average Money (AMI) to possess homes buying otherwise constructing homes in the Colorado, Ohio, Nebraska and Oklahoma. This new HSP exists to homes because the an effective forgivable grant with good five-seasons maintenance period.